#Home mortgage calculator plus

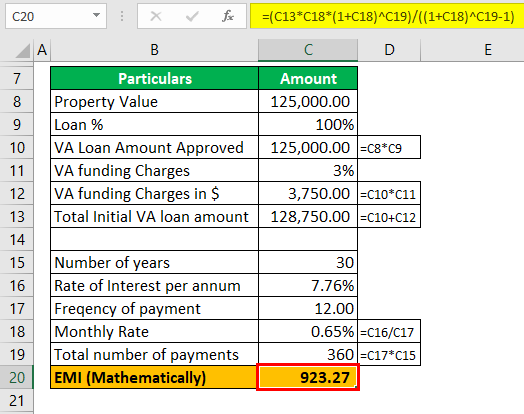

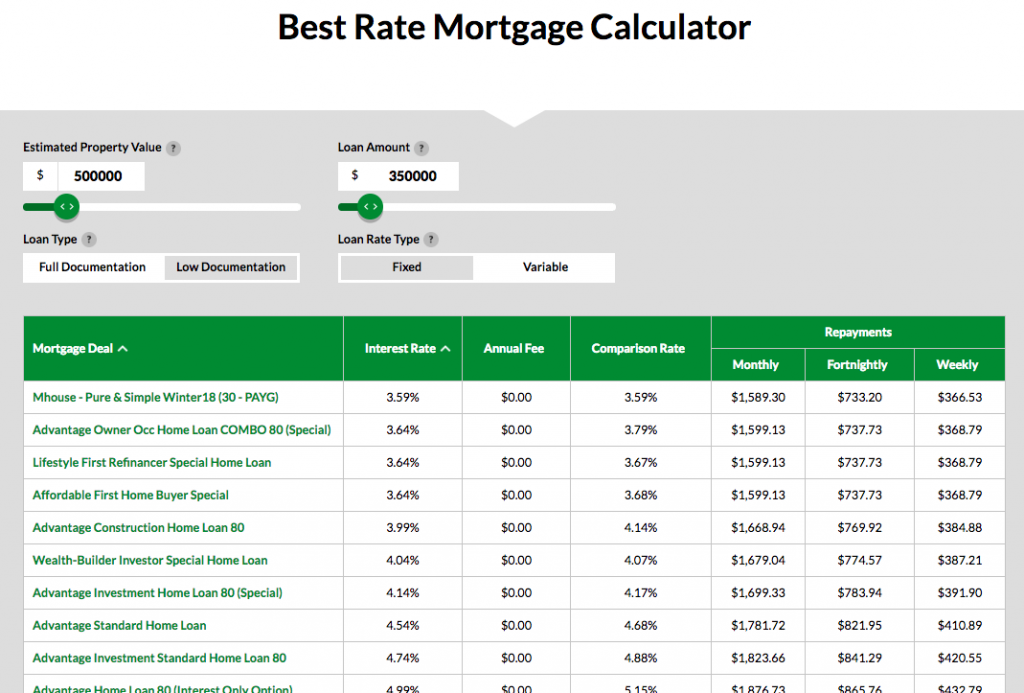

The amount owed on the loan at the end of every month equals the amount owed from the previous month, plus the interest on this amount, minus the fixed amount paid every month. The following derivation of this formula illustrates how fixed-rate mortgage loans work. Some mortgage lenders are known to allow as high as 55%. Generally speaking, lenders do not like to see all of a borrower's debt payments (including property expenses) exceed around 40% of total monthly pretax income. One can test different loan sizes and interest rates. It can also factor in a potential mortgage payment and other associated housing costs ( property taxes, homeownership dues, etc.). A mortgage calculator can help to add up all income sources and compare this to all monthly debt payments. A lender will compare the person's total monthly income and total monthly debt load. If one borrows $250,000 at a 7% annual interest rate and pays the loan back over thirty years, with $3,000 annual property tax payment, $1,500 annual property insurance cost and 0.5% annual private mortgage insurance payment, what will the monthly payment be? The answer is $2,142.42.Ī potential borrower can use an online mortgage calculator to see how much property he or she can afford. Mortgage calculators can be used to answer such questions as: In contrast, mortgage calculators make answers to questions regarding the impact of changes in mortgage variables available to everyone. These tables generally required a working understanding of compound interest mathematics for proper use. Prior to the wide availability of mortgage calculators, those wishing to understand the financial implications of changes to the five main variables in a mortgage transaction were forced to use compound interest rate tables. When purchasing a new home, most buyers choose to finance a portion of the purchase price via the use of a mortgage.

#Home mortgage calculator software

There are also multiple free online free mortgage calculators, and software programs offering financial and mortgage calculations.

Mortgage calculation capabilities can be found on financial handheld calculators such as the HP-12C or Texas Instruments TI BA II Plus. More complex calculators can take into account other costs associated with a mortgage, such as local and state taxes, and insurance. The major variables in a mortgage calculation include loan principal, balance, periodic compound interest rate, number of payments per year, total number of payments and the regular payment amount. Mortgage calculators are frequently on for-profit websites, though the Consumer Financial Protection Bureau has launched its own public mortgage calculator. Mortgage calculators are used by consumers to determine monthly repayments, and by mortgage providers to determine the financial suitability of a home loan applicant. Tab will move on to the next part of the site rather than go through menu items.Mortgage calculators are automated tools that enable users to determine the financial implications of changes in one or more variables in a mortgage financing arrangement. Enter and space open menus and escape closes them as well.

Up and Down arrows will open main level menus and toggle through sub tier links. Left and right arrows move across top level links and expand / close menus in sub levels. The site navigation utilizes arrow, enter, escape, and space bar key commands.

0 kommentar(er)

0 kommentar(er)